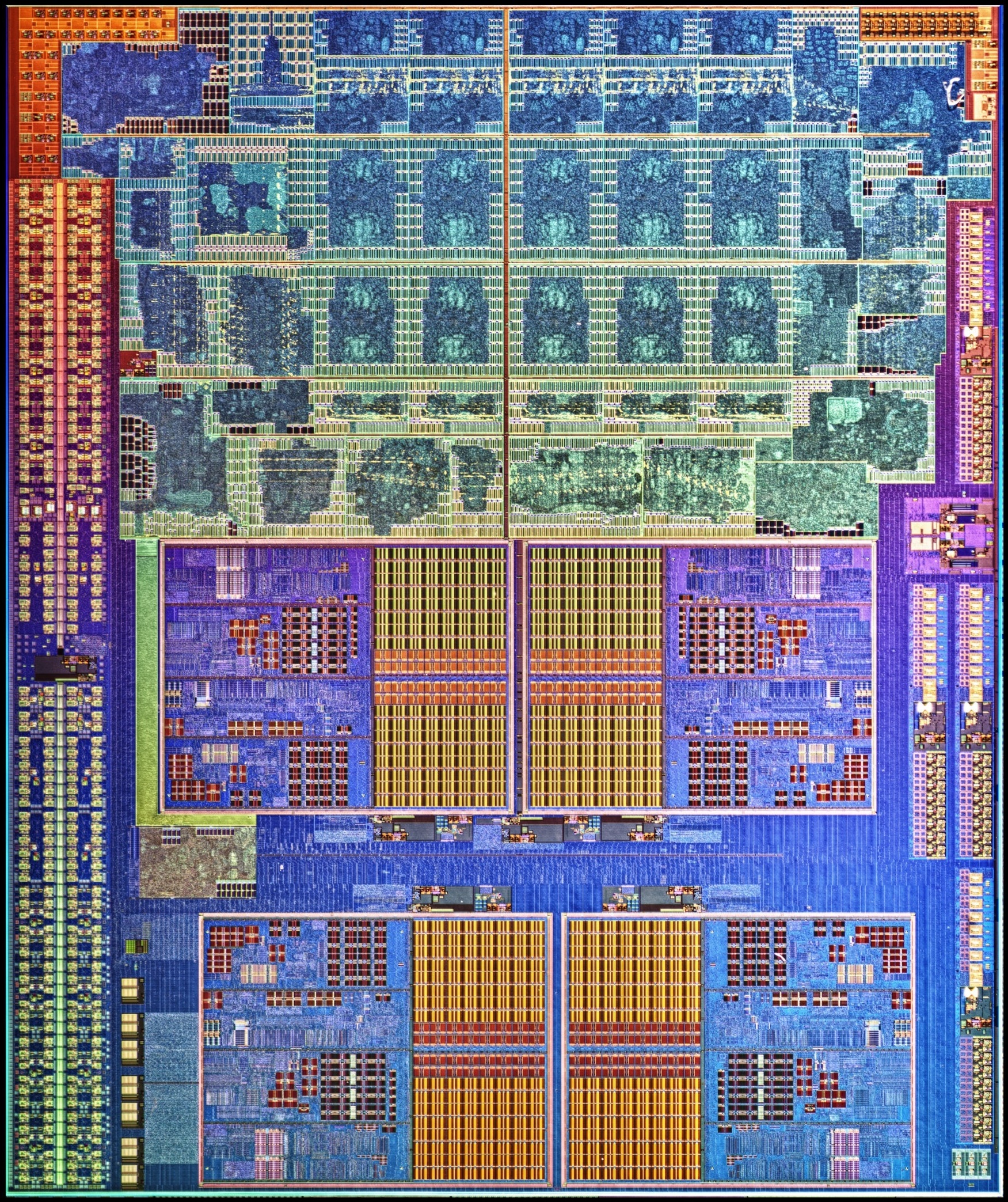

AMD Llano and A series was launched early this quarter, and we start to near the end of it it is time for AMD to sum up things in a fiscal report. AMD has released its preliminary Q3 results, which was lower than expected. It says it is because of poor yields at GlobalFoundries.

AMD launched in the middle of July, Llano for notebooks, and later on the models for desktops. Llano and the A series is in stores for desktops, but the availability for notebooks has been rather poor. There have been rumors of poor Llano yields, something AMD confirms with its preliminary quarterly fiscal report.

“The less-than-forecasted preliminary third quarter 2011 revenue results are primarily due to 32 nanometer (nm) yield, ramp and manufacturing issues at GLOBALFOUNDRIES in its Dresden, Germany factory that limited supply of “Llano”. Additionally, 45nm supply was less than expected due to complexities related to the use of common tools across both technology nodes. AMD continues to work closely with its key partner GLOBALFOUNDRIES to improve 32nm yield performance in order to satisfy strong demand for AMD products.”

The problem is at GlobalFoundries’ Fab in Dresden, Germany, where it has problems with yields and unable to supply AMD with the quantities it has ordered. There has also been problems with the older 45nm node at the same time, due to the complexity of the same, or similar tools for both processes.

The problem is at GlobalFoundries’ Fab in Dresden, Germany, where it has problems with yields and unable to supply AMD with the quantities it has ordered. There has also been problems with the older 45nm node at the same time, due to the complexity of the same, or similar tools for both processes.

The 32nm process AMD uses at GlobalFoundries is the most advanced in the world shipping to conusmers. It is the first to combine SOI and HKMG, while it use a Gate-First approach during manufacturing. Even though AMD has the btter technology today, we should not forget that Intel is just six months from launching the first products at 22nm. Then with Tri-Gate transistors that is expected to drive energy cosnumption to new low levels.

Notebooks with Llano is starting to appear in stores.

To summarize the bad results are due to poor availability, and “other products with higher ASP (Average Selling Point)” (Bulldozer?) than the assortment before Q3. The results are still in the black since AMD managed to boost income with 4 – 6% from Q2, but it has estimated a boost of 10%. AMD has several years in the red behind it, and debt so this is still positive that numbers are largely in the black.

Source: AMD